epf withdrawal i sinar

For now they are only accepting applications for members under Category 1 which do not require additional supporting documents. If you need extra cash the i-Sinar program by the Employees Provident Fund EPF is now open for application.

Why I Sinar Went Wrong And Why Epf Contributors Shouldn T Be Treated Like White Knights Consumers Association Penang

They could decide to withdraw a certain amount of money from their Account 1.

. 3 rows i-Sinar eligible amount. This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19 pandemic helping them sustain their livelihood. There are no conditions for i-Sinar application.

Do take note that. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. The withdrawal amount will vary depending on.

The EPF strongly advises members to avoid sharing photos or documents of their i-Sinar submissions or withdrawals on social media as. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. During the past two years Malaysians have been allowed to make several rounds of withdrawals from their EPF savings through i-Lestari i-Sinar and i-Citra schemes which resulted in a withdrawal of RM 101 billion by 74 million members.

The latest withdrawal showed that only eight per cent of the EPF members which withdrew their savings have less than RM1000 in the account. EPF mmembers can mafe the withdrawal at httpspengeluarankhaskwspgovmy through the i-Account starting 1 April. However the amount withdrawn will be subject to the account balance.

Originally the i-Sinar programme was only catered to EPF members who suffered pay cuts or lost their jobs during the pandemic. What this means is that the majority of the withdrawals were made by the M40 and T20 income groups who have enough savings in their EPF account whereas the remaining B40 were unable to do so due to the fact. The Employees Provident Fund EPF announced in a press release yesterday 16 November that certain members can start accessing their savings in Account 1 Calling the scheme i-Sinar the initiative aims to relieve the financial burdens of EPF members whose livelihoods have been affected by the COVID-19 pandemic.

However in February 2021 the government announced that the i-Sinar is now expanded to all EPF members. This is a withdrawal facility where members can withdraw up to RM60000 from Account 1. Follow us on Instagram and Twitter for the latest updates.

Though the i-Sinar facility is a helpful initiative by the Government to aid Malaysians especially those who were made unemployed or have experienced a pay cut the subject has been under much scrutiny from various parties including think tanks financial councils and EPF themselves. How much can you withdraw from EPF i-Sinar. The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. 1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently. The actual amount that you can withdraw under.

This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. What is outlined are the criteria to ensure that the application matches the EPFs internal data which will easily and securely expedite the approval process. The i-Sinar program was introduced to assist members who are affected by the current pandemic situation.

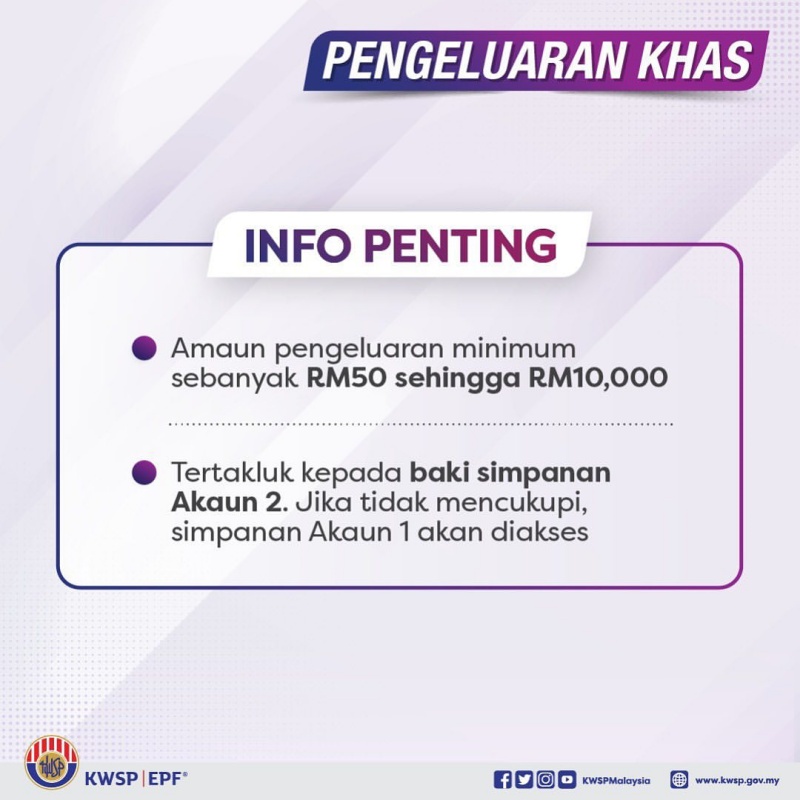

The eligible amount for i-Sinar is subject to the members Account 1. They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1. EPF members are allowed to withdraw a maximum amount of RM10000 and a minimum of RM50.

The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1. Without a proper guideline on the risks and opportunities it may not be entirely. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties.

The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds.

Epf Releases Faq To Explain Key Details Of I Sinar Cyber Rt

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Takaful Household Plan Protection Plans How To Plan Protection

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Rm10 000 Epf Special Withdrawal Everything You Need To Know Soyacincau

Those Withdrawing From Epf Without A Good Reason Must Pay 2 5 In Zakat

Need To Withdraw More Funds Epf I Sinar Applications Can Now Be Amended Online

Epf Issues Sombre Reminder Of Retirement Crisis Risk Ahead Of Another Special Withdrawal On April 1

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

𝐊𝐖𝐒𝐏 𝐢 𝐒𝐢𝐧𝐚𝐫 𝐏𝐫𝐨𝐠𝐫𝐚𝐦𝐦𝐞 舒家聊房 Show Jot Property Talk Facebook

I Sinar And I Citra Not Heavily Impacting Epf Investment At The Moment The Star

Epf Member To Withdraw From I Sinar Account Swoon Lea

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Everything You Need To Know About The Latest Epf Special Withdrawal Hype Malaysia

Report Epf Expected To Gain From Trimming Mostly Banking Stocks Amid Brouhaha Over Interest Free Loan Moratorium

Image The Star Survival Animal Spirit Cards Retirement Fund

Retirement Savings Are Depleting Epf Warns Amid Calls For More Withdrawals Bebasnews

I Sinar Withdrawal A Case Of Desperate Times Calling For Desperate Measures Now And Also In The Future Businesstoday

Comments

Post a Comment